MONTREAL (QUEBEC) – Management of SIRIOS RESOURCES INC. (TSX-V: SOI) is pleased to announce the filing on SEDAR of the technical report “Mineral Resource Estimate Update for the Cheechoo Project, Eeyou Istchee James Bay, Quebec”, with an effective date of July 20, 2022. The report, compliant to NI 43-101 standards and completed for Sirios by BBA, includes an updated mineral resource estimate of the Cheechoo Gold Project, located in Eeyou Istchee James Bay, Quebec.

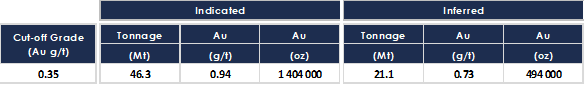

The updated mineral resource estimate (Table 1), based on an open pit constrained model, includes an indicated resource of 1.4 million ounces of gold contained in 46.3 million tonnes at an average grade of 0.94 g/t Au, and an inferred resource of 0.5 million ounces of gold contained in 21.1 million tonnes at an average grade of 0.73 g/t Au.

Table 1: Conceptual pit constrained Indicated and Inferred Resource Estimate for the Cheechoo Project

Dominique Doucet, President and CEO of Sirios, stated, “Once again, I wish to congratulate our technical team for this achievement which led us to an updated resources estimation, which now includes more than 74% of the gold ounces classified as indicated resources in addition to a significant increase of the gold grade of the Cheechoo deposit. We have again demonstrated that the Cheechoo project improves significantly with each new exploration campaign undertaken on the property. Moreover, exploration work continues in the area of the conceptual pit, with the goal of increasing the mineral resources. As demonstrated by recent trenching results in the metasediments to the east of the deposit, the discovery potential across the property remains excellent.”

The mineral resource estimate has been prepared by consulting firm BBA in accordance with the Definition Standards of the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) as defined in the National Instrument 43-101 (“NI 43-101”). The estimate is based on data from 329 diamond drill holes totaling 76,713 metres and 386 channels totalling 3,217 metres which were completed by Sirios between 2012 and 2022. The full technical report is now available on SEDAR (www.sedar.com) under the Corporation’s profile as well as on Sirios’ web site.

Sirios’ press release issued on December 6, 2022 (entitled “Sirios Announces Indicated Resource of 1.4 M oz at 0.94 g/t and Inferred Resource of 0.5 M oz at 0.73 g/t Gold at Cheechoo”) summarized the key results contained in the 2022 Cheechoo mineral resource estimate update.

Notes to the MRE Table:

- The independent qualified person for the 2022 MRE, as defined by NI 43-101 guidelines, is Pierre-Luc Richard, P. Geo., of PLR Resources Inc. The effective date of the estimate is July 20, 2022.

- These mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of reported Inferred resources in this MRE are uncertain in nature and there has been insufficient exploration to define these resources as Indicated or Measured; however, it is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- Resources are presented as undiluted and pit constrained, and are considered to have reasonable prospects for economic extraction. A cut-off grade of 0.35 g/t Au was used for the MRE. The pit optimization was done using Deswik mining software. The constraining pit shell was developed using pit slopes of 45 to 50 degrees in hard rock and 26 degrees in overburden. The cut-off grade and pit optimization were calculated using the following parameters (amongst others): Gold price = USD1,650; CAD:USD exchange rate = 1.29; Hard Rock Mining cost = $2.90/t mined with incremental bench costs of $0.05 per 10 m bench; Overburden Mining Cost = $5.00/t mined; Mining Recovery = 95%; Mining dilution = 5% at 0 g/t Au; Metallurgical Recovery varying from 84% to 92%; Processing cost = $14.57/t processed; G&A = $5.42/t processed; and Refining and Transportation cost = $5.00/oz. The conceptual pit-constrained resource has a 2.3:1 stripping ratio at the 0.35g/t Au cut-off grade. The mineral resource cut-off grade was calculated at 0.32 g/t Au, however a more conservative cut-off grade of 0.35 g/t Au was used for the mineral resource estimate. The cut-off grade will be re-evaluated in light of future prevailing market conditions and costs.

- The MRE was prepared using Surpac 2022 Refresh 1 and is based on 329 surface drillholes (76,713m) and 386 surface channel samples (3,217m), with a total of 55,566 assays. The resource database was validated before proceeding to the resource estimation. Grade model resource estimation was interpolated from drillhole and channel data using an OK interpolation method within blocks measuring 10 m x 10 m x 10 m in size. The cut-off date for drillhole database was July 20, 2022.

- The model comprises 20 mineralized zones (which have a minimum thickness of 3 m, with rare exceptions mostly between 2 and 3 m), and two low-grade mineralized bodies mostly included in the tonalite intrusive unit, each defined by drillhole intercepts. The block model was reblocked to 10 m x 10 m x 10 m using the weighted average grade and tonnage from high-grade and low-grade zones.

- High-grade capping was done on the composited assay data and established on a per zone basis. Capping grades vary from 3 g/t Au to 55 g/t Au. A value of zero grade was applied in cases where the core was not assayed.

- Fixed density values were established on a per unit basis, corresponding to the median of the SG data of each unit ranging from 2.65 t/m3 to 2.76 t/m3. A fixed density of 2.00 t/m3 was assigned to the overburden.

- The MRE presented herein is categorized as Indicated and Inferred Resources. The Indicated Mineral Resource category is defined for blocks that are informed by a minimum of two drillholes where drill spacing is less than 50 m for the intrusive-related mineralization applied to 10x10x10m reblocks. The Inferred Mineral Resource category is defined for blocks that are informed by a minimum of two drillholes where drill spacing is less than 100 m for the intrusive-related mineralization applied to 10x10x10m reblocks. Where needed, some materials have been either upgraded or downgraded to avoid isolated blocks.

- The number of tonnes (metric) and ounces were rounded to the nearest hundred thousand.

- CIM definitions and guidelines for mineral resource estimates have been followed.

The scientific and technical content of this press release has been reviewed and approved by Mr. Dominique Doucet, P.Eng. President and CEO of Sirios Resources Inc. and Mr. Jordi Turcotte, P. Geo. Senior Geologist who are both “Qualified Persons” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Cheechoo property

Sirios’ 100% owned Cheechoo property is located in the Eeyou Istchee James Bay region of Quebec, approximately 200 km east of Wemindji and less than 10 km from Newmont’s Eleonore gold mine.

About Sirios

Sirios Resources Inc. is a Canadian-based mining exploration company focused on developing its portfolio of high-potential gold properties in the Eeyou Istchee James Bay region of Quebec.

Cautionary note regarding forward-looking information

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation based on expectations, estimates and projections as at the date of this news release. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, capital and operating costs varying significantly from estimates; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental or other project approvals; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; fluctuations in commodity prices; delays in the development of projects; the other risks involved in the mineral exploration and development industry; and those risks set out in the Company’s public documents filed on SEDAR at www.sedar.com. Although the Company believes that the assumptions and factors used in preparing the forward looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward- looking information, whether as a result of new information, future events or otherwise, other than as required by law.

The estimate of Inferred Mineral Resources mentioned in this press release conform to National Instrument 43-101 standards and was prepared by Pierre-Luc Richard, P. Geo., independent qualified person, as defined by NI 43-101 guidelines. The effective date of the estimate is July 20, 2022. The above-mentioned mineral resources are not mineral reserves as they do not have demonstrated economic viability. The quantity and grade of the reported Inferred Mineral Resources are conceptual in nature and are estimated based on limited geological evidence and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity.