1. OVERVIEW

The Aquilon project covers 68 km2 of the Aquilon greenstone belt, in the La Grande subprovince of Quebec. This is an advanced exploration project on which more than 32 gold showings have been discovered so far. Some of these showings are defined by gold grades that are among the highest ever intercepted in Quebec:

- 834.4 grams of gold per tonne (g/t Au) over 1.7 m (Moman showing), including 3,527.4 g/t Au over 0.4 m;

- 116.5 g/t Au over 2.3 m (Moman showing);

- 425.3 g/t Au over 0.6 m (Moman showing);

- 133.7 g/t Au over 0.8 m (Fleur-de-Lys showing);

- 26.7 g/t Au over 0.4 m (Muscovite showing).

Gold mineralization is associated with felsic horizons of volcano-sedimentary units of the Aquilon greenstone belt. It occurs mainly in two forms, namely high-grade vein-type mineralization, defined along a NE-SW trending topographic lineament, and lower-grade mineralization contained in volcaniclastics and associated with disseminated to semi-massive sulphides.

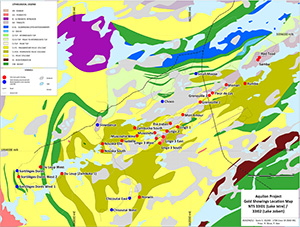

2. LOCATION

The Aquilon property is located in Quebec, Canada, on the territory of Eeyou Istchee James Bay. It is accessible in all seasons via the James Bay road and the Trans-Taïga and is located about 10 km south of the Laforge-1 hydroelectric power station. It is also located less than 60 km from Pourvoirie Mirage, which offers accommodation, meals and an airstrip. The Aquilon property consists of a block of 140 claims covering an area of 68 km2.

3. GEOLOGY OF THE PROPERTY

The Aquilon greenstone belt is mainly composed of four lithological units, namely mafic and felsic volcanic units, ultramafic units and iron formations. The western part of the property is characterized by an erect anticline regional fold, plunging moderately to the NW. It is bordered by polyphased tonalitic intrusives of the Coates Suite and tonalitic and dioritic gneisses of the Brésolles Suite. The property is centered on a bimodal volcanic sequence with a core occupied by a felsic calc-alkaline complex. The rocks of the Aquilon volcano-sedimentary belt were metamorphosed to lower to upper amphibolite facies and locally retrograded to greenschist facies. Structural data and overprint relationships indicate that the western part of the Aquilon volcano-sedimentary belt has undergone at least five ductile and brittle deformation events, namely D1 to D5.

4. TYPE OF MINERALIZATION

Gold mineralization is associated primarily with felsic complexes of the Aquilon greenstone belt. Currently, two types of mineralization have been identified on the property:

1) Orogenic vein gold mineralization:

This type of mineralization is mainly present along a topographic lineament called the Wolf Corridor. This zone is defined by 24 high-grade gold showings distributed laterally over more than 4 km. Several of these showings, including Lingo-3-West, Fleur-de-Lys and Moman, form N-NE oriented shallow dipping ore shoots. Mineralization is hosted within quartz veins with minor amounts of calcite and occurs as coarse gold grains associated with minor amounts of sulphides (pyrite-pyrrhotite ±chalcopyrite ±sphalerite ±galena). The walls of the veins expose hydrothermal alteration in sericite and pyrite of varying intensity.

2) Gold associated with semi-massive to disseminated sulphide horizons (pyrite-pyrrhotite ±chalcolpyrite):

This type of lower grade mineralization is hosted in various types of lithologies on the property including felsic to intermediate volcaniclastics, basalts, lapilli tuffs and tonalitic intrusions. It occurs in the form of multi-centimetric to metric bands enriched in pyrite, pyrrhotite and chalcopyrite. These zones show large muscovite and disseminated pyrite alteration halos.